Terminals

End-to-End Managed Solutions

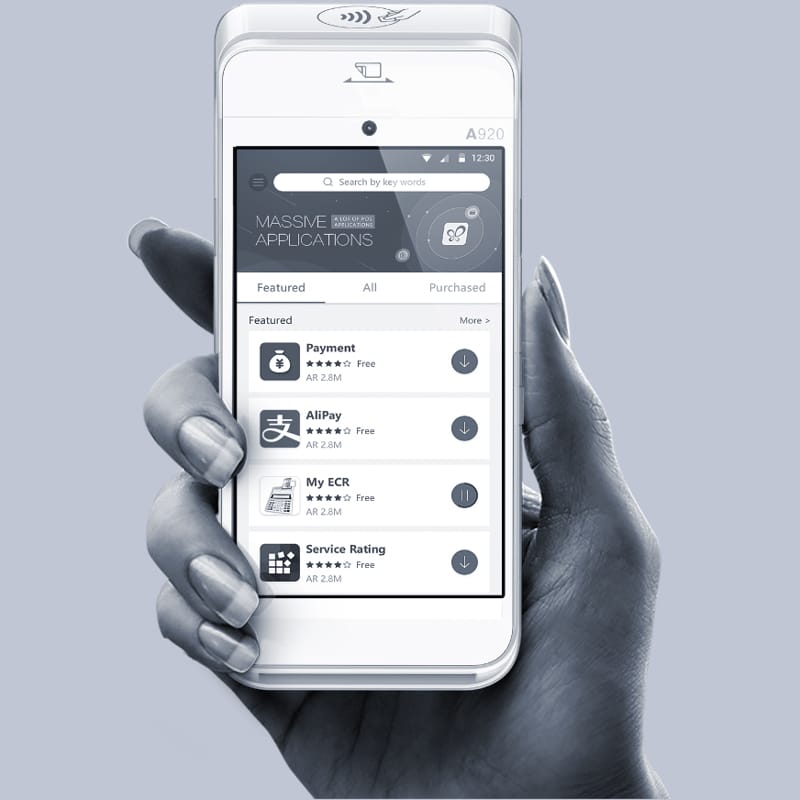

PAX Terminals

PAX "Preferred partner of the year 2021"

PAX Technology is an innovative global provider of electronic payment solutions, offering world-class, cost-effective and superior quality products. Building on its service excellence and proven leadership position, PAX is one of the fastest growing payment industry suppliers with state-of-the-art manufacturing facilities, excellent research and development capabilities and a worldwide network of sales and channel partners.

PAX have more than 40 million terminals, including 1 million Android terminals, deployed in more than 120 countries worldwide. Sales of the new-generation Smart Android payment devices now account for over 25% of total group revenue.

A good example of how PAX can help reduce complexity is the fact that in addition to all the other things we put into our solutions, such as the latest PCI 5 certifications, the latest contactless technology, it is now becoming standard practice for PAX to now put inbuilt cameras into portable, desktop, multilane and ECR terminals. These cameras function as 2D barcode scanners to read QR Codes and can also handle facial recognition. PAX has also introduced a common EMV kernel across the range thus making it simpler and more cost effective for certification requirements.

POS Terminal Software

We have vast experience in developing applications for POS terminals with a full time team of software developers and quality assurance based in Mauritius, United Kingdom and Zimbabwe. We are licensed for the PAX Software Development Kit (SDK) which means that if the standard software requires modification to suit user requirements, we are able to make these changes in-house.

We develop all our POS software in-house. We have developed several POS applications that use different message protocols to suit different payments environments in Africa. Our POS devices and applications use dial, IP (Ethernet), GPRS, 3G, 4G and Wi-Fi means of communications, and accept magnetic stripe, chip and PIN as well as contactless cards.

In line with advances in the mobile phone industry, we have developed, and are in the process of certifying, our POS applications to run on the Android platform, giving banks, merchants and customers new unparalleled payment experience.

Retail

Merchant payments for small one-till shops to large multi-lane check out stores with integrated PIN pads

Banks

Bank branch either with a full terminal or with a PIN pad integrated to a teller PC

Cardless

Cardless applications that support mobile money purchases and cash out transactions

Mobile POS

Mobile POS (mPOS) integrating to Windows, Android and ios-based smartphones

Medical

Medical claims verification systems at point of sale

Agency

Agency banking allows financial institutions to expand by transforming any shop into a bank

Terminal Hardware Support

- FULFILLMENT - TPS forecasts the units required during deployment and normal service then places orders with the POS manufacturers.

- INSTALLATION - Terminal software installation and secure key injection.

- ASSET TRACKING - The serial numbers of all terminals supplied by TPS are tracked internally for delivery, service and repair history.

- TERMINAL SWAPS - Faulty terminals are returned to the local TPS office for swap and repair. Terminals that are covered by support will be repaired and returned to your stock.

- REPAIRS - To ensure a high level of customer service and satisfaction, TPS provides a full repair and refurbishment service to our contracted customers.

- TERMINAL UPGRADES - Operating system, software and firmware upgrades can be carried out by remote downloads or at our service centre.

- HELP DESK - TPS runs a help desk facility where customers log faults that are investigated and resolved, or escalated if necessary to 3rd line support.

Terminal Management Service

We have developed our own terminal-agnostic terminal management system (TMS) that allows for application and parameter downloads to industry-standard terminals including PAX and Verifone. Our TMS also features application version control, support for ad hoc downloads, reporting and asset management.

Benefits

- TMS guarantees success of downloads. If there is disconnection during a download, for example when 40% of the download is processed, when the connection is restored, the download resumes from 40% instead of 0% as in the current set-up.

- On TMS, the Bank can manage a terminal estate with multiple terminal brands (multi-tenancy), as opposed to one brand currently.

- It has asset management functionality, which ordinarily is not part of a TMS. The terminal tab provides the detail pertaining to the status of all of the terminals allocated to a business, helping in asset tracking.

- With TMS, even business personnel can manage the configurations via a web portal using log-in credentials, not just technical people.

- TMS provides an effective backup solution to easily re-populate the TMS in the situation where the TMS has to be replaced e.g. hardware failure.